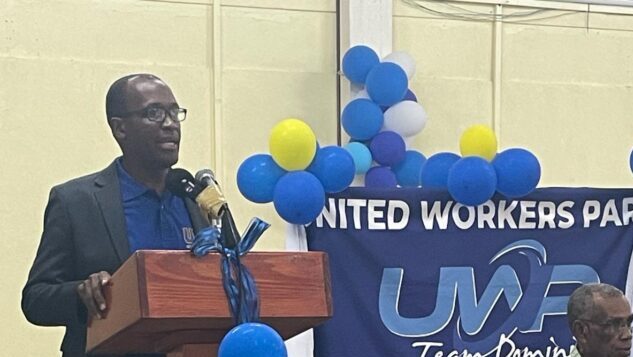

Minister of People Empowerment and Elder Affairs Kirk Humphrey says the Economic Diversification And Growth Fund Bill is a measured, transparent and accountable response to Barbados’ economic realities and long-term social needs.

In a press release titled Understanding The Economic Diversification And Growth Fund, he acknowledged that debate over the Bill had been “strong and, in many cases, emotional”, but said such reactions were understandable when public funds, employment and the country’s economic future were at stake.

“What the country deserves in return is a calm and factual explanation,” he said.

Humphrey pointed out that Barbados, as a small open economy, does not print foreign currency and therefore relies heavily on foreign exchange earnings to pay for essential imports such as food, fuel and medicine, while maintaining economic stability.

He noted that changes in international rules governing tax incentives had narrowed Government’s traditional policy options, requiring a shift towards “disciplined, transparent and rules-based approaches that deliver real outcomes”.

Within that context, the minister said the Economic Diversification and Growth Fund was designed to link public support to measurable performance. Companies seeking assistance must commit to creating significant employment for Barbadians, earning foreign exchange, remaining tax compliant and establishing a long-term presence in the country, he outlined.

“These are firm expectations,” he said, adding that funds could be withheld or recovered where commitments were not met, and that oversight mechanisms, including monitoring and annual audits by the Auditor General, were built into the framework.

He said support under the fund was limited to companies that create at least 100 jobs for Barbadians and maintain those jobs for a minimum of seven years.

The proposed fund will be capped at $225 million over three years, with annual allocations of $75 million. Humphrey said this represented roughly half of one per cent of Barbados’ gross domestic product per year.

“That scale is targeted, time-bound and manageable for a Government that has demonstrated steady and credible economic management over the past seven years,” he said.

Responding to concerns about the use of public funds, he stressed that the resources involved belonged to the people of Barbados and therefore had to be applied carefully in ways that strengthened the economy and expanded opportunity over time.

He argued that when employment grows and foreign exchange earnings increase, benefits extend beyond individual companies to households and the State. Increased revenue, he said, reduces pressure on social programmes and improves the country’s capacity to fund health care, education and targeted social support.

Humphrey cautioned of the consequences of inaction, noting that weak job creation and foreign exchange earnings in a small economy place strain on families first, before increasing demands on public finances. Using public funds to strengthen the economic base, he said, helped reduce that strain and provided greater longterm stability.

Challenging the notion that social policy should focus only on responding after problems arise, the minister said effective social development required creating economic space first, which could then be used to build skills, opportunity and dignity, particularly for the most vulnerable.

Addressing claims that the fund prioritised companies over people, Humphrey said people benefited most when jobs were created and the economy remained stable, since wages, public services and social programmes depend on a strong revenue base.

He also rejected suggestions that the policy sidelined local businesses, pointing out that many Barbadian firms were oriented towards the domestic market and already benefited from lower corporate tax rates, domestic financing and sector-specific support. Engagement with local businesses, he said, would continue, while the fund addressed a different need: large-scale employment and foreign exchange generation.

Humphrey dismissed concerns that the Bill vested excessive power in a minister, saying decisions would be informed by a multi-agency committee and guided by senior public officials. The advisory committee includes the Director of Finance and Economic Affairs, the Governor of the Central Bank, and the chief executive officers of Invest Barbados and Export Barbados.

“The minister acts on advice and within authority granted by Parliament, as is standard in public finance,” he said, emphasising that the structure prioritised review and accountability.

(CLM)