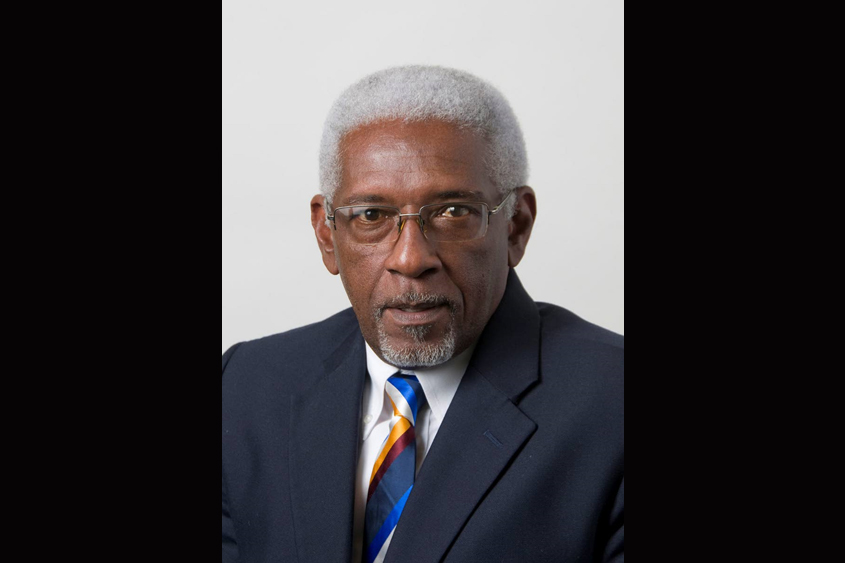

The Government-owned Enterprise Growth Fund Limited (EGFL), which has now provided about half billion dollars in funding to small and medium-sized firms since its establishment 26 years ago, is anticipating a tourism sector-led rise in demand for loan financing.

Chairman Conde Riley says EGFL also anticipates that should the battery storage-related challenges in the renewable energy sector be resolved soon, the number of requests for green energy loans should also increase.

He was reflecting on his organisation’s performance for the financial year ended March 31, 2024, noting that a reduced appetite for borrowing, linked to the COVID-19 pandemic, was evident during 2022 and 2023.

However, Riley says: “Despite the potential challenges with inflation and other issues, there is still the expectation that the local economy will continue to expand.

“Therefore, with confidence slowly returning to the business sector, we anticipate that demand for loan financing is likely to come predominantly from operatives in tourism and other closely linked sectors.

“However, if the efforts being made by stakeholders to resolve the issues currently plaguing the renewable energy sub-sector bear fruit in the short term, demand from our clients for green energy loans is likely to increase significantly.”

He noted that there was a 22.6 per cent year-on-year reduction in credit growth between 2022 and 2023 and that “as uncertainty persisted during 2023, business owners continued to be cautious and sought to pay down existing debt and repair some of the damage that had been inflicted by the COVID-19 pandemic”.

“Another issue which likely contributed to the relatively weak demand for loans during the review period was the inability of the electrical grid, as configured, to accept additional intermittent energy,” he explained.

“Prior to this development, EGFL and several other financial institutions were experiencing strong demand for loans in the renewable energy sub- sector. However, the absence of adequate battery energy storage systems has brought much of the build-out in the green economy to a halt.”

The chairman reported in EGFL’s 2024 annual report that Barbados’ economic recovery “has led to improved reflows for EGFL and its funds under management, particularly those serving the hospitality sector”.

“This had a positive impact on revenues for EGFL which improved from $3.86 million in 2023 to $4.05 million for the period ending March 31, 2024. Meanwhile, expenses increased in step with rising inflation by 6.5 per cent to register $3.3 million in 2024,” he shared.

“Consequently, EGFL earned $402 000 of total comprehensive income for 2024, $198 000 less than that of 2023 primarily due to losses incurred in the re-measurement of the pension plan.”

Riley said that “as a result of the increased reflows and the relatively slow uptake of new loans during the review period, EGFL and its tourism and renewable energy financing windows are now well placed to provide the capital needed for the expansion of businesses in these critical sectors of the economy”.

“Encouragingly, as we enter the new financial year, there is evidence that business confidence is returning to ‘normal’ levels and strong demand for loan financing is likely to follow. We remain committed to facilitating the viable projects of our client-class as they seek to capitalise on value- enhancing opportunities,” he stated.

From its establishment in 1998 to March 31 last year, EGFL and its funds under management approved financing of $591.07 million and disbursed $458.60 million to the small and medium-sized sector, Riley said. (SC)